Upgrade Your Drupal Skills

We trained 1,000+ Drupal Developers over the last decade.

See Advanced Courses NAH, I know Enough2016 990 and Audit

Last year, the Drupal Association committed to not only providing more transparency into our financials, but also more clarity about where our funds come from and what they fund.

We completed our 2016 Audit and official financial reporting at the end of 2017. This post gives insight into 1) the audit 2) the 990s (our official financial report for the year) and 3) a new financial report called the “Weather Report”. 990s provide a one-year snapshot of program financials, but some of our programs have two years of expenses, like DrupalCon, so just looking at the 990s never gives the exact insight into how our events perform. The weather report provides this clarity. It will expand over time to provide clarity for more of our programs as well.

We did a financial audit for 2016

Audits are a good thing. In fact, our operations department welcomes them and appreciates the feedback.

To assist our board in their fiduciary obligations, we strive to conduct audits every other year. In the years that we don’t do an audit, we contract with our CPA firm, McDonald Jacobs, to do a financial review.

We conduct an audit for several reasons:

- to demonstrate our commitment to financial transparency.

- to assure our community that we follow appropriate procedures to ensure that the community funds are being handled with care.

- to give our board of directors outside assurance that the financial statements are free of material misstatements.

For our 2016 audit, our auditors focused on three points:

- Proper recording of income and expense: our auditors ensure that our financial statements are an accurate representation of the business we have conducted. Did we record transactions on the right date, to the right account, and the right class? In other words, if we said that 2016 revenue was a certain amount, is that really true?

- Financial controls: preventing fraud is an important part of the audit. It is important to put the kinds of controls in place that can prevent common types of fraud, such as forged checks and payroll changes. Our auditors looked to see that there are two sets of eyes on every transaction, and that documentation is provided to verify expenses and check requests.

- Policies and procedures: there are laws and regulations that require we have certain policies in place at our organization. Our auditors looked at our current policies to ensure they were in place and, in some cases, had been reviewed by the board and staff.

The primary goal of this audit is for our auditor to express an opinion on two aspects of the financial statements of the Association: the financial statements are fairly presented, and they are in accordance with generally accepted accounting principles (GAAP). Generally accepted accounting principles are the accepted body of accounting rules and policies established by the accounting profession. The purpose of these rules is to promote consistency and fairness in financial reporting throughout the business community. These principles provide comparability of financial information.

Our audit for 2016 is complete and has been reviewed and approved by the board. The results of our audit can be found here.

In short, we received a clean bill of health with one recommendation from our Auditors (which is VERY good). It is in how we open and deposit incoming checks:

"Controls over Checks Received

With the elimination of our physical office during 2016, the control of segregating certain duties has been eliminated. The Accountant now processes checks received in the mail. In this situation where the Accountant has access to the physical asset and the accounting records, there is an opportunity to misappropriate a check and void or delete the invoice billing in the accounting system. To mitigate the risk of this occurring without detection, the following recommendations can provide additional control:

- As part of the monthly reconciliation process performed by the outside CPA firm, a review of voided and/or deleted invoices can be done with appropriate follow up and resolution.

- Consider using a lockbox with your bank."

While our security checks are tight, adding the bank lock box process was suggested by our auditors to add an additional layer of security to prevent potential fraudulent activity.

A lockbox is a physical post office box controlled by the bank. Checks are directed to this post office box, or “lockbox”, and checks are opened and scanned by bank employees. Those checks are deposited into our account, and scans of the checks are uploaded and recorded in our banking portal. This can be accessed and seen by all members of our accounting team. Checks are now recorded into our accounting system by a different team member, since checks are now digitized and deposited by the bank - and are no longer physically deposited by only one team member.

Tax filing: The IRS Form 990

Once the audit is finished, our CPA can complete the 990 tax return for the year.

All U.S.-based 501c3 exempt organizations are required to file a 990 each year. Additionally, this form is also filed with state tax departments as well. The 990 is used by the IRS and state regulators to ensure that non-profits continue to serve their stated charitable activities. The 990 can be helpful when you are reviewing our programs and finances, but know this is only a “snapshot” of our year.

You can find our past 990s here.

Here are some general points, when reviewing our 990:

FORM 990, PART I—REVENUES, EXPENSES, AND CHANGES IN NET ASSETS OR FUND BALANCES

Lines 8-12 indicates our yearly revenue. Not only how much total revenue (line 12), but also where we have earned our income, broken out into four groups. Line 12 is the most important: total income for the year which ended at $5.1 million.

Lines 13-18 shows expenses for the year which totaled $6.1 million for the year.

Cash Reserves are noted on line 20 of page 1. Our year ended with 186k in net assets. The 990 has a comparison of the net assets from last year (or the beginning of the year) and the end of the current year, as well as illustrates the total assets and liabilities of the Association. We ended 2015 with -$92K, and with our refocus in 2016 we closed the year up, at $185k in net assets.

FORM 990, PART II—SIGNATURE BLOCK

Sign off on our 990 by our Treasurer Tiffany Farriss & CPA Representative McDonald Jacobs partner Sang Ahn.

FORM 990, PART III—STATEMENT OF PROGRAM SERVICE ACCOMPLISHMENTS

In Part III, we describe the activities performed in the previous year that adhere to our 501c3 designation. You can see here that Drupal.org, DrupalCon and our Fiscal Sponsorship programs are highlighted noting the expenses and income for each program. Keep in mind that this is only a year snapshot, as DrupalCons span a couple of years, ramping up and winding down.

FORM 990, PART IV - CHECKLIST OF REQUIRED SCHEDULES

This is a checklist of schedules that must be completed and accompany the 990 filing. Any “yes” answers checked here will produce a schedule to explain the “yes” answer in detail.

FORM 990, PART V - STATEMENTS REGARDING OTHER IRS FILINGS AND TAX COMPLIANCE

This is a place for statements about other IRS filings and tax compliance such as receiving tax deductible contributions, and noting that we have provided donors with required substantiation for their donations.

FORM 990, PART VI - GOVERNANCE, MANAGEMENT AND DISCLOSURE

This is for us to note detailed information regarding our governing body, management, and policies of our organization.

FORM 990, PART VII - LIST OF OFFICERS, DIRECTORS, TRUSTEES AND KEY EMPLOYEES

Part VII lists our board and staff who are responsible in whole or in part for the operations of an organization. These entries do include titles and compensation of key employees.

Section B—Compensation of the Five Highest Paid Independent Contractors for Professional Services

We list any of our contractors, if we have paid them more than $50,000, on this schedule.

FORM 990, PART VIII - Statement of Revenue

This is a snapshot of where our revenue comes from, what is exempt or not exempt as taxable income. For 2016, $573,247 was considered taxable.

FORM 990, Part IX Statement of Functional Expenses

This section classifies the total amount earned for the year into three different buckets; fundraising, general, and program expense. These are expenses related to running those three different types of programs.

FORM 990, Part X, XI and XII Balance Sheet

This is a comparison of our 2016 balance sheet from beginning of the year to the end of the year, along with notes about the account method we use (accrual) and independent auditor and who is responsible for oversight.

Additional Filing to the 990, Schedule A — Public Charity Status and Public Support

A tax exempt organization must meet certain public support tests in order to maintain its status as a public charity. Schedule A provides an opportunity to see the various sources of revenue have increased or declined over the last four or five years. Please be aware that the definitions of revenue for the purposes of the support schedule are not directly comparable to Part I of the Form 990.

Additional various schedules following the 990, show large contributions (5k +), activities outside of the United States (ie grants given outside of the US), assets depreciation and other various activities.

Now that our 2016 990 has been reviewed by the board and approved, we have filed it. From there we are required to post the return publicly, which we do here on our website.

Weather Report — Review of 2016

As part of our work to ensure financial health, our virtual CPA firm Summit compiles a “weather report” monthly so we can compare particular data points and see if we are reaching to our set KPIs.

In closing the year 2016, Summit prepared this report for the year.

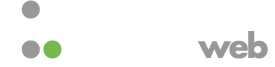

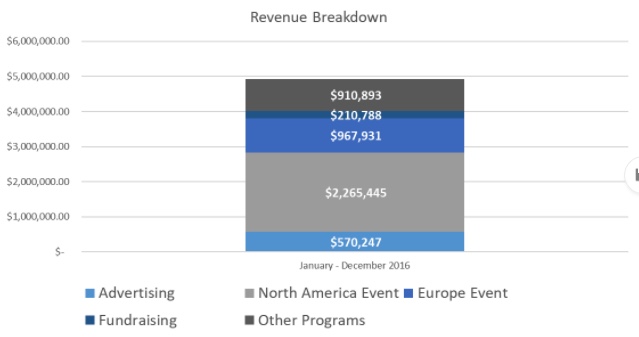

Revenue —the Drupal Association creates income in four different ways:

- Advertising, which consists of ad sales on Drupal.org.

- Events - DrupalCon income

- Fundraising consisting of any donations or membership sales

- Other Income, which comprises income from digital sponsors, Supporting Partner sales and time and material projects.

The graph below shows the breakdown of revenue for 2016.

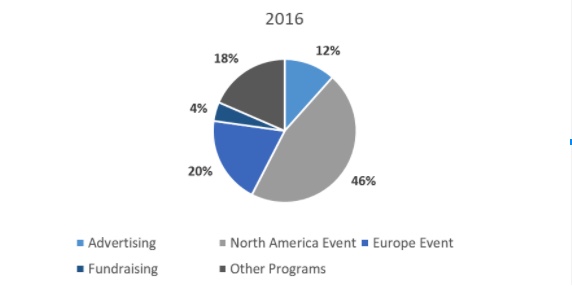

Expenses — The Drupal Association has expenses which are categorized in the following ways:

- Production Expense:These are the costs associated directly with earning revenue (for example: paying employees who work directly with the revenue streams described above, direct event costs, marketing event costs, IT costs, etc.)

- Administrative Costs: These are general costs associated with running the organization (for example: administrative employees, accounting fees, insurance, professional fees, etc)

- Sales and Marketing Costs: These are costs for marketing the Drupal organization (mostly Marketing employees)

- Facility Costs: These are costs associated with the physical office space employees work. (Drupal moved a distributed workforce in the end of 2016, so these costs will be minimal going forward.)

KPI Goals — Moving into 2017, we set the following goals for Drupal.org.

- Cash Reserve – Have 30% of forecasted YTD revenue in the bank. As of the end of 2016 we have $397K (27% of the goal) in the bank.

- Net Income – Have a Year End Net Income greater than 10%. In 2016 we achieved a Net Income margin of -1%.

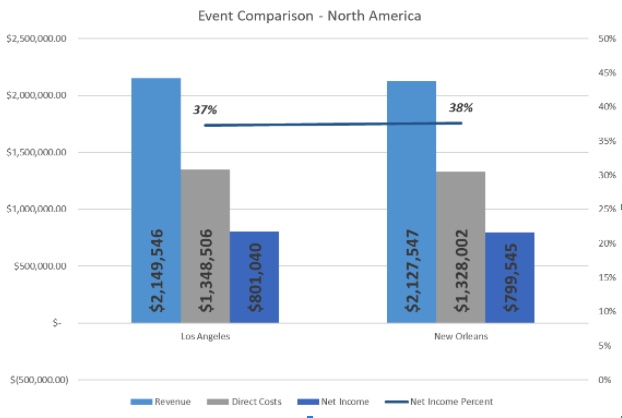

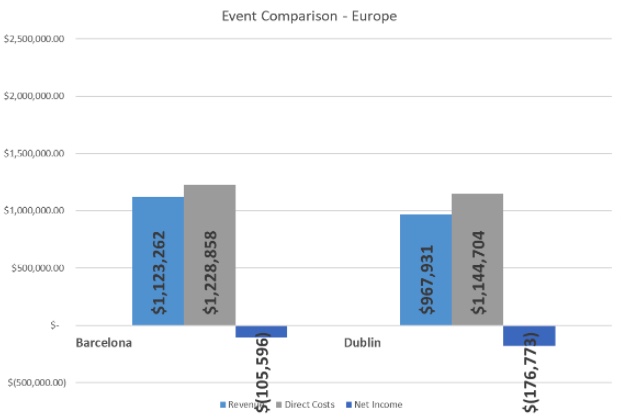

Event Summary — The graphs below present the 2016 and 2015 DrupalCon events

2016 results show us in the middle of our financial recovery. As we moved into 2017, we took deep looks into our operations and programs to ensure financial health and growth. We will have a 2017 update after we close our financial review and 990 filing for the year.

We are thankful for the great team work that went into new financial reporting process and the resulting data to help us push towards our financial goals. Additionally, and as always, we are truly thankful to our financial contributors who provide the financial fuel for us to do our mission work.

About Drupal Sun

Drupal Sun is an Evolving Web project. It allows you to:

- Do full-text search on all the articles in Drupal Planet (thanks to Apache Solr)

- Facet based on tags, author, or feed

- Flip through articles quickly (with j/k or arrow keys) to find what you're interested in

- View the entire article text inline, or in the context of the site where it was created

See the blog post at Evolving Web